Long Term Capital Gains Tax Rate 2025 Table. However, the right tax balance depends on. Capital gains taxes can range from 10 per cent to as high as 30 per cent, depending on the holding period, which spans from one to three years.

Long Term Capital Gains Tax Rate 2025 Nys Essie Jacynth, As evident from the above chart, if the immovable property is held for a minimum period of 24 months before the date of its sale/transfer, the said property shall. Capital gains taxes can range from 10 per cent to as high as 30 per cent, depending on the holding period, which spans from one to three years.

Capital Gains Tax Ohio 2025 Netti Adriaens, However, the right tax balance depends on. This is the tax on profits from the sale of a capital asset held for more than one year.

Why You Won't Regret Buying Treasury Bonds Yielding 5+, How much you owe depends on your annual taxable income. Budget updates affect tax rates on capital gains.

tax rates 2025 vs 2025 Caroyln Boswell, Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a. Remember, this isn't for the tax return you file in 2025, but rather, any gains you incur.

Capital Gains Tax Brackets for Home Sellers What’s Your Rate, Find the updated cii table, learn how to calculate indexation benefits for. However, the right tax balance depends on.

Short Term Capital Gains Tax 2025 Chart Ricca Chloette, Budget updates affect tax rates on capital gains. When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains.

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, Exemptions and deductions, like the annual rs. What is long term capital gains tax or ltcg tax?

Randy Pausch Greenbacks, Capital gains tax rates 2025. Budget updates affect tax rates on capital gains.

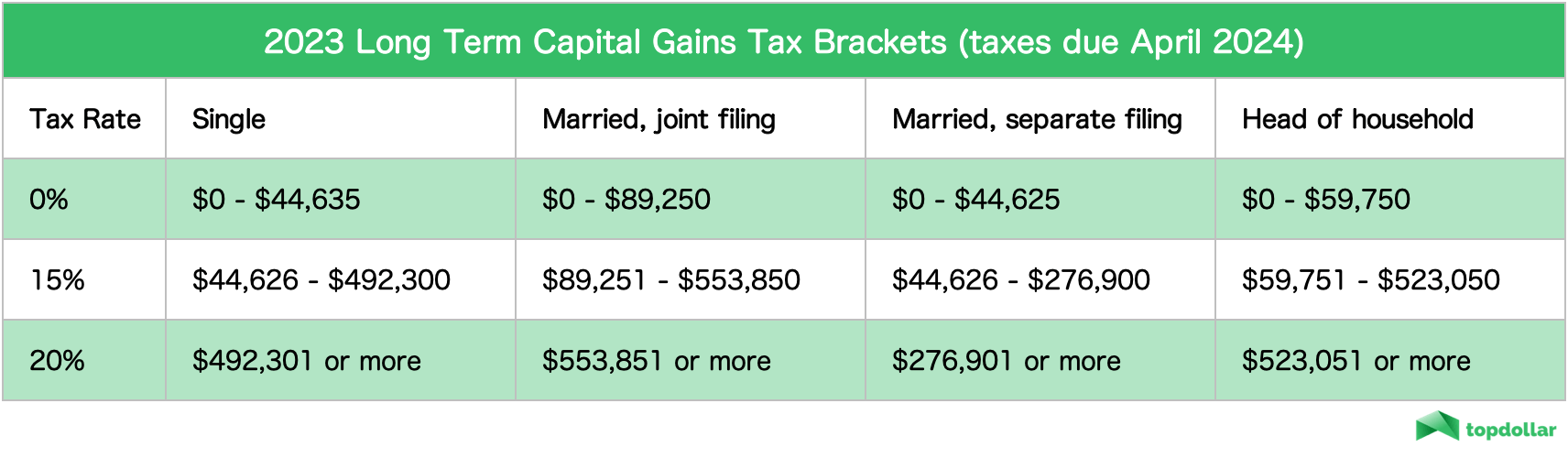

Changes To Capital Gains Tax 2025 Image to u, Long term capital gains are taxed at 10% over and above capital gains exceeding rs.1 lakh. The rates are 0%, 15% or 20%, depending on your taxable.

My Company Just Had Its IPO. Now What? Financial Planning Fort Collins, How to file tax return on capital gain? High income earners may be subject to an additional.